Month: October 2013

Americans Say Creating Jobs Is Key to Improving Economy

October 14, 2013

Job creation and hiring top Americans’ list of what federal gov’t, businesses can do

WASHINGTON, D.C. — As lawmakers in Washington focus on opening the government after the Oct. 1 partial shutdown, raising the debt limit, and debating the merits of the Affordable Care Act, Americans say creating jobs is the most important way for the federal government to improve the economy.

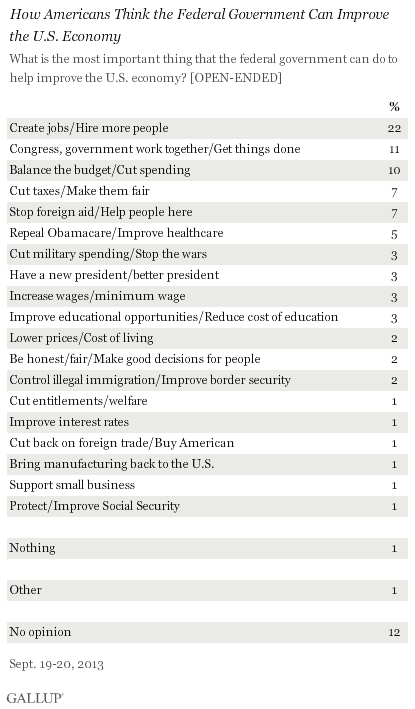

These results are based on a Gallup poll conducted Sept. 19-20, prior to the government shutdown on Oct. 1, in which Americans were asked in an open-ended format to say the most important thing the federal government can do to improve the U.S. economy. The 22% who mentioned creating jobs were not more specific about how this could be accomplished. Previous Gallup research has shown that Americans favor spending government money on a series of job creation proposals, including lowering taxes for businesses that create jobs in the U.S. and a program that would employ people to work on infrastructure repair projects.

Second on Americans’ list of suggestions — that Congress should figure out how to cooperate and get things done — mirrors the types of responses Americans give when asked why they disapprove of the job Congress is doing. This also fits with the recent finding that Americans say dysfunction in government is the most important problem now facing the nation.

The next three recommendations have to do with how the government deals with the money it controls, including balancing the budget and cutting spending, changing the way Americans are taxed, and redirecting foreign aid monies to domestic concerns. The fact that a combined 21% of Americans focus on Congress working better together or balancing the budget suggests that a sizable minority see the current conflict in Washington as affecting the economy. This connection is reinforced by the recent and dramatic drop ineconomic confidence after the Oct. 1 shutdown.

Although defunding the healthcare law has been a controversial sticking point in the debate over funding the government and avoiding the shutdown, relatively few Americans (5%) mention repeal or taking other actions to improve healthcare as the best way to help the economy.

Americans’ Top Suggestion to Businesses: Hire More Workers

In the same poll, Gallup asked Americans what businesses and corporations themselves could do to improve the economy, and creating jobs again topped the list. Thirty-one percent of Americans say businesses can create jobs and hire more people, and 8% each cite bringing manufacturing back to the U.S. and paying higher wages.

Other suggestions with at least 5% of mentions deal with governmental, rather than business, actions, including changes to the healthcare law or system, and Congress and the government working together. Fewer Americans recommend that businesses treat their people better and watch their bottom line.

Implications

Americans have reacted negatively toward Washington politicians’ inability to work together to end the government shutdown and the current brinksmanship over the pending federal debt ceiling deadline. Thus, it is not surprising that some Americans see greater governmental cooperation and compromise as the best way for the federal government and corporations to improve the U.S. economy. Even so, at a time of decliningeconomic confidence, the public believes that creating jobs is the key to a robust economy.

President Barack Obama tried to refocus on the economy in a series of speeches this summer, but the Syrian conflict, controversy over the healthcare law in Congress, and fiscal debates have seemingly drawn attention away from his economic agenda. Americans who suggest that cooperation in Washington is the top way to improve the economy may feel that by quickly resolving issues such as the federal budget and the debt limit, lawmakers and business leaders may be able to turn their attention to improving the economy.

U.S. Standard of Living Index Sinks to 10-Month Low

Expectations for future standard of living drops more than current satisfaction

PRINCETON, NJ — In yet another sign that partisan wrangling over the federal budget is rattling the American consumer, Gallup’s Standard of Living Index has tumbled eight points in the past month to 31, its lowest reading since January.

The index is a summary of whether Americans are satisfied with their current standard of living and perceive it as getting better or worse. Although the index has a theoretical maximum of 100 (and a theoretical minimum of -100), the highest it has been since tracking began in 2008 is 45, attained in May 2013.

The recent decline echoes sentiments seen in Americans’ broader attitudes about the U.S. economy, although the magnitude in the decline in the Standard of Living Index is not as great. Gallup’s Economic Confidence Index faltered during the run-up to the government shutdown in late September, and has fallen further in October since the shutdown began, for a total decline of 24 points since mid-September.

Mainly a Crisis of Optimism

Both components of the Standard of Living Index have soured since mid-September; however, the decline in Americans’ outlook for their standard of living has been steeper, dropping nine points, compared with a six-point drop for current satisfaction.

Longer term, since the start of August, Americans’ net satisfaction with their standard of living has varied relatively little — generally registering in a four-point range between 47 and 51, except for the one reading of 53 in mid-September. By contrast, net optimism about one’s standard of living has registered in a 12-point range, from scores of 27 to 15.

Index Is Down Among All Income Groups

The eight-point decline in the index over the past month is seen fairly evenly across major income groups. At the same time, perceptions of standard of living soured more with Democrats and Republicans than among independents, whose standard of living rating was already relatively low.

Bottom Line

Gallup’s Standard of Living Index now matches the low for this year, last recorded in early January, shortly after the Congress passed an 11th-hour budget agreement that avoided sending the federal government over a so-called “fiscal cliff.” That kind of drama has been replayed in the past month with similar effects on Americans’ confidence in the economy and their standard of living. The good news is that, while the current Standard of Living Index — at 31 — is down from the heights it reached earlier this year, it remains higher than the lowest readings in each of the previous five years. This indicates that, while the bottom has not yet fallen out of Americans’ satisfaction with their standard of living, there is the capacity for it to fall even further.

India’s Banking Credit growth

Image Posted on Updated on

India’s Banking Credit growth

latest release by India Central Banker RBI Reserve Bank of India 25th October 2013

In Billion Indian Currency Rupee term

China Import of Iron Ore

Image Posted on Updated on

China Import of Iron Ore from 2008 to February 2013

US Workfoce : Since End of U.S. Recession, More Seniors in Workforce

October 17, 2013

Fewer Americans aged 18 to 29 in the labor pool

WASHINGTON, D.C. — As the U.S. economy continues its sluggish recovery from the recession and global economic crisis, more seniors and fewer young adults are in the workforce now compared with 2010. There has been a three-point increase since 2010 in the percentage of Americans aged 65 and older who are in the workforce — employed full time through an employer, self-employed, working part time, or unemployed but actively searching for work. At the same time, there has been a two-point decrease in the percentage of Americans aged 18 to 29 who are in the workforce.

These results are based on more than 350,000 interviews per year with U.S. adults aged 18 and older. Examining the changing composition of the workforce population since 2010 offers a glimpse into how the labor market has changed as the nation recovers from the 2008-2009 economic recession.

The recession contributed to significant household wealth reductions that Americans are still trying to recoup. Older Americans’ desire to replenish their retirement savings may partly explain the three-point increase in the percentage of seniors in the workforce, as more postpone retirement or former retirees re-enter it. In addition, Gallup’s employment data show that 12% of those 65 and older are employed full time for an employer or are self-employed full time in 2013 versus 9% in 2010, suggesting that older Americans may be keeping their full-time jobs.

For young adults, joblessness during the recession may have accelerated the trend of living at home with their parents, softening the effects of not having a paycheck. It is also possible that more young adults decided to continue their education in a challenging labor market. A Heritage Foundation study using U.S. Census Bureau data showed a 4.5% increase between 2007 and 2012 in the percentage of 16- to 24-year-olds who remained out of the workforce due to school.

Younger, Less Educated Americans Experience Drop in Workforce Participation

Among Americans aged 18 to 29, the biggest change in workforce participation between 2010 and 2013 is a two-point decrease in the percentage of those with a high school education or less. This may be explained by the inability of some in this group to find work or by their simply seeking more schooling. For 18- to 29-year-olds with some form of higher education, the decreases in employment were more modest.

Those aged 65 and older experienced workforce increases among all levels of educational attainment. This includes four-point increases among those with undergraduate degrees and those with postgraduate education. Workforce participation among seniors who have a high school education or less remained relatively stable, at 18% in 2013 versus 17% in 2010.

Bottom Line

There are more seniors and fewer 18- to 29-year-olds in the workforce now compared with 2010. The sluggish recovery from the Great Recession may explain some of these changes in workforce composition.

Americans’ biggest financial concern is funding their retirement, with 61% worried about having enough money for that. This worry has been exacerbated by the recession’s aftermath, which has perhaps caused more seniors and baby boomers near retirement age to remain in the workforce and postpone retirement until they have replenished their nest eggs. However, some of these seniors are likely remaining in or even entering the workforce out of personal choice, not necessity. A recent survey suggests that half of U.S. adult employees earning at least $75,000 say they will continue working after retirement by choice, while pluralities of lower-income workers intend to remain in the workforce more out of necessity.

Conditions within the labor market have not improved as quickly as policymakers and economists have hoped, with Bureau of Labor Statistics job reports falling short of expectations. Slower job creation and fewer vacancies due to older generations’ postponing retirement have contributed to a tough environment for young job seekers, 20% of whom are now out of the workforce.

With the recent plummet in economic confidence tied to uncertainty about the government shutdown and debt ceiling talks, a renewed sense of optimism in job markets and financial markets is unlikely in the near term. More young adults may drop out of the workforce if they struggle to find quality employment or seek to improve their marketability through higher education. It is also possible that more seniors will participate in the workforce if baby boomers for economic reasons postpone their retirement or re-enter the workforce.